Americans who require immediate cash are using cash advance apps increasingly frequently. 79% of Americans have used an online lending provider at least once in their lives, according to a new Consumer Financial Protection Bureau research. People use these facilities most frequently because they desire a quick way to receive money when they need it most.

Individuals who lack the patience to wait for traditional bank loans or credit card approvals used cash advance apps. Web development company developed these types of apps.

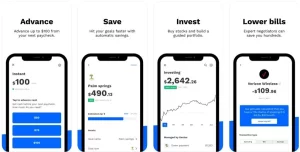

Albert

You can borrow up to $250 from Albert to help you get by. No interest costs, credit checks, late fees, or other undeclared involvement with your money. As soon as you have a paycheck and have paid it back your prior advances, you may ask for up to three cash advances per pay period.

Dave

Comparable to the earlier programmes, it provides overdraft protection. As a result, you can effortlessly request loans by connecting this app to your bank account.

They therefore informed you before about every transaction that overdraws your account. The software, in this instance, offers a $100 loan to maintain your account. It subsequently deducted this sum from your upcoming paycheck.

Empower

One of the best cash advance apps created for the current generation is Empower. Whatever comes, they’ll enable you to prosper by letting you borrow more money. You may save money for the future and get a cash advance of up to $250 by installing the app.

There are no applications, interest charges, late fees, credit risks, or applications. Simply repay them instantly when you get your subsequent bank transfer.

Chime

Customers can use Chime’s SpotMe function to overdraw their account balances by a small, fixed sum without incurring fees. Chime is a mobile startup that provides checking and savings accounts as well as credit-builder loans. Purchases that would lower your account balance.

B9

Apps like B9 attempt to assist underserved customers of banking institutions and unbanked consumers, who are frequently the targets of predatory lenders. The B9 app provides transfer services, a B9 Visa® Cards with up to 4% reward, FDIC insurance, and zero-fee loans of up to 15 days, giving users exceptional flexibility as they manage their daily obligations.

MoneyLion

A credit-building loan, cash advances up to $250, cash flow tracking, mobile bank and retirement savings, and the app are all available. Anyone with a qualified bank account is eligible for the Instacash loan Although it claims there are no fees or interest associated with the cash advance, it may request you to leave a tip if you accept one.

Current

A spectacular alternative to cash advance apps is current. It is a straightforward banking software with overdraft security. Simply open a bank account and sign up for the Overdrive service are all that is required.

The software is capable of defending you against an overdraft transaction. This means that, similar to the aforementioned apps, every time your bank account experiences such a payout, current offers a $100 loan. For any transaction, there are no fees or interest requirements. The app from the upcoming expected deposit smoothly deducted your loan.

Wealthfront

It performs equally well as the other cash advance apps on our list. Users of the app have access to a mobile banking service that allows them to obtain their paycheck two days before the deadline. However, it does not amuse consumers who have paid a specific amount in advance. It comes out to be a fruitful long-term partner with many, as per reports.

Varo

Varo could be your destination if you keep up with the most recent payday loan apps. Recently, a cash advance option was added to this widely used digital banking software. As a result, it functions as an effective amalgam of both borrowing and lending apps.

However, Clients, never suffer any fees for making late payments. The app forbids a user from taking out any additional loans in the event that a loan is past due.

Branch

The cash advance apps Branch operates in conjunction with your company. It implies that this app enables direct wage transfers from your company to your debit cards. In order to issue a loan, it also keeps track of a user’s work time. The software divides a portion of your regular salary equal to 50% when you request an advance.

It subsequently taken this sum out of your following paycheck. Users are required to pay a little charge in addition to receiving an instant loan.

Conclusion

With the right app, you can now go out there, snag a few moments with a stranger and get them to hand over some cash. Hopefully, you’ve been inspired by these top 10 cash advance apps for instant money in 2023 list and are excited about giving one of these a try.